Concise, comprehensive and easy to read the Creditsafe business credit report (powered by Equifax) gives you the most important information required to make informed decisions, quickly and easily.

Business credit reports made simple

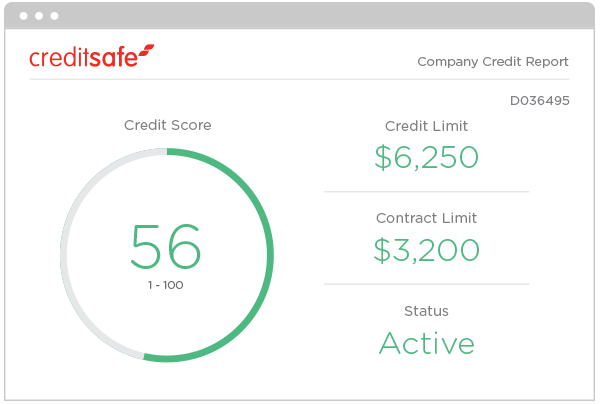

Credit Risk Scores

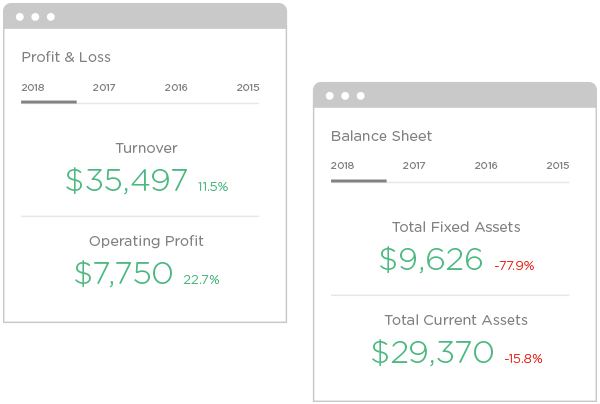

Financial Data

Business Information

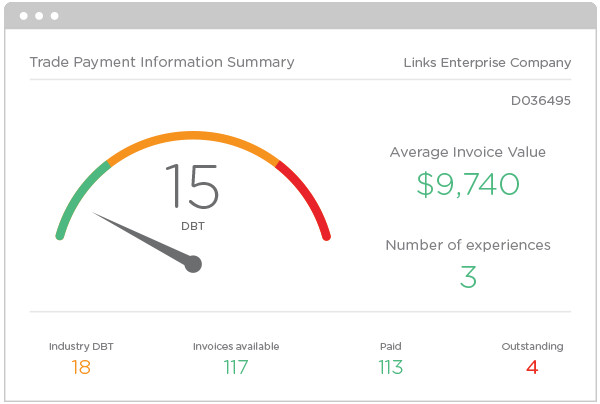

Payment Behaviour

Given the economic volatility of recent years, it has become more important than ever to assess the financial viability of your customers and suppliers. Our credit assessment model uses a variety of factors from public and propriety sources to provide you with the visibility into a business’s overall credit risk profile.

Included within our Credit Risk Score Suite are a number of scores used to answer key credit decisions. Our scores can predict the likelihood of the following events happening within the next 12 months:

- Businesses becoming severely delinquent in paying its non-financial trades

- Businesses becoming severely delinquent in paying its small business banking trades

- Businesses cease trading resulting in losses for its creditors

If you are considering a potential merger, takeover or tendering process, or you would simply like some further information on a potential customer or supplier then Creditsafe can provide you the insight you need.

The Equifax database powering our Canadian reports includes data collected from small business banking trades from financial institutions and industry Accounts Receivable data. This data is then enriched further with commercial firmographic information such as sales volumes, number of employees and ownership information.

In order to avoid fraudulent behaviour and loss of revenue when dealing with new customers it is vital that you can validate the authenticity of a prospective client. It is for this reason that we include the following data as standard in all our reports:

- Company name

- Legal name

- Address

- Phone and fax numbers

- Industry codes

- Employee size

- Sales volumes

For additional insight, Creditsafe can also offer a list of additional businesses associated with the business principal or guarantor, as reported within the Equifax database.

In order to make informed credit and lending decisions it is important to understand the payment behaviour of your customers. It is for this reason that we highlight credit reference details such as payment habits for a business’s credit cards, lines of credit and fixed term loans as reported by our Financial Trade Contributors. To give you as much information as possible we will include credit available, utilization percentage, ratings and total debt outstanding.

So that you are fully aware of payment behaviours we also include data on derogatory items such as:

- Returned cheques

- Collection claims

- Legal suits and judgments

Why use Creditsafe’s Business Credit Reports?

-

Accelerate Credit Decisions

Minimise manual reviews with predictive delinquency scores

-

Establish Risk Tolerance Levels

Identify and set acceptable cut off scores for business customers

-

Identify Payment History

Assess payment behaviours to determine future payment activity

Monitor companies that are important to your business

Stay up to date with any critical changes that occur within your portfolio with customisable alerts send directly to your inbox.

It is just as important to monitor your existing customers and suppliers, as it is to check your new business acquisitions. With Creditsafe, you can monitor companies of interest in 19 countries worldwide. Customise which notifications you receive, view event history and risk band distribution per portfolio, and schedule an export of your portfolios on a daily, weekly or monthly basis to make managing your risk more straightforward.

-

Monitor changes to company information

Receive updates via email of any changes to the companies that of our interest to you. Get notified of changes such as change of address, credit score or ownership to name a few.

-

Monitor trade debtors and delinquent payers

Changes in key performance indicators such as credit scores could be an early warning sign there are potential problems within a company. Stay ahead of any potential losses in revenue by getting instant alerts.

-

Export updates

Export your entire portfolio with all of the up-to-date business information appended. You can select the information that you want to see from 17 different categories.

Ways you can access Creditsafe company data

We offer a whole host of ways to access our data, with our most popular options including:

-

Website

View full company credit reports from our entire global database online. Access reports from over 160 countries in an instant, or order a fresh investigation for anywhere else in the world.

-

API

Integrate hundreds of data fields with your CRM or ERP system with a single API. Enrich your data with real-time information allowing you to make trusted decisions and drive automation.

-

Index Files

Receive scheduled exports of comprehensive data files covering European companies. Choose from our modularised data sets, such as marketing or accounts, ensuring you only pay for the data you need.

-

Bespoke Data

Our most personalised data service allows you to create truly bespoke data lists featuring your chosen companies, regions or industries with an extensive list of data fields for you to hand pick from.