Tap into global company, consumer and compliance data via our RESTful API, to automate your KYB checks.

Using our most powerful API yet, you can access countless data such as detailed company profiles, financial performance data, and director & shareholder information through one single API. Our integration also offers global coverage with information on businesses in more than 160 countries, available instantly.

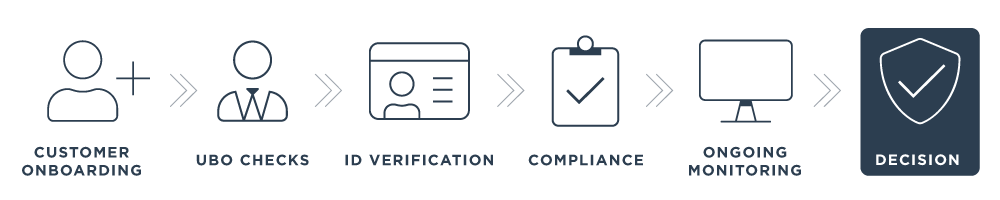

Improve your customer experience whilst reducing drop-off rates with accurate and efficient compliance checks.

Creditsafe compliance solutions provide the platform for you to verify the individuals and businesses you are trading with, whilst ensuring this doesn’t interfere with the speed of your business.