Governments throughout the world are tightening their regulations in response to a continuous rise in bribery and corruption, putting businesses that engage with Politically Exposed Persons (PEPs) under increased scrutiny. Protect your business and ensure compliance by employing a higher degree of due diligence which meets anti-bribery laws and helps combat corruption. Creditsafe’s PEPs and Sanction checks enable your business to exhibit strong governance all the while upholding a reputation of integrity.

Protect your business with PEPs and Sanction checks

Streamline one-off checks and on-going monitoring

Secure your business' compliance and reputation with an on-going solution

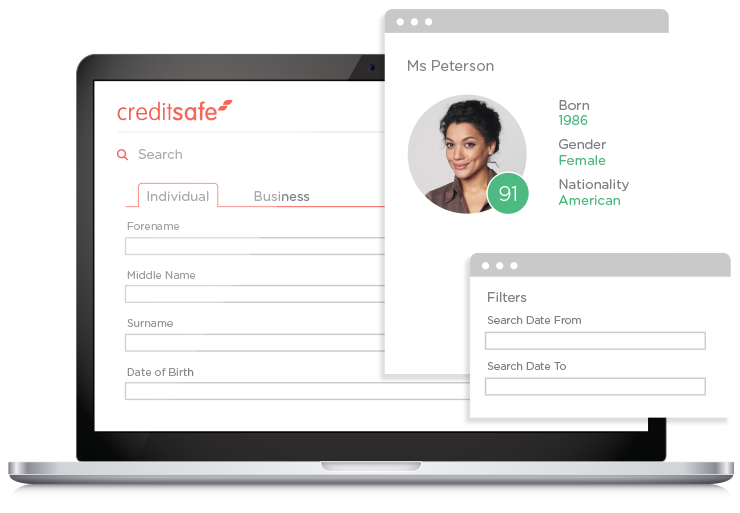

Online PEPs & Sanction checks

Streamline your Politically Exposed Persons (PEPs) and Sanctions compliance with instant online checks, which screen against a multitude of global and domestic databases in one go. Increase efficiency, protect your business against the threat of non-compliance and mitigate the risk of large fines with Creditsafe’s online Compliance Search.

Operate in the knowledge that your business is employing robust due diligence measures, so you are able to make an informed and confident decision on who you do business with.

On-going monitoring

On-going monitoring is a critical component of your compliance with the 4th Anti-Money Laundering Directive. At Creditsafe, we understand that ensuring these are performed regularly can be a resource strain for many organisations.

Maintaining up-to-date compliance checks becomes effortless with Creditsafe’s on-going monitoring feature. Our tool removes the need to manually schedule compliance monitoring updates, allowing your teams to focus on other priorities.

Add both individuals and businesses to be screened against the PEPs and Sanction databases on a daily basis, allowing you to relax in the knowledge that you are continually working with trusted partners and customers. As soon as we receive an update to suggest a change in circumstance to those which you monitor, Creditsafe's on-going monitoring will alert you so that you can make an informed decision on how to proceed.

On-going monitoring

On-going monitoring is a critical component of your compliance with the 4th Anti-Money Laundering Directive. At Creditsafe, we understand that ensuring these are performed regularly can be a resource strain for many organisations.

Maintaining up-to-date compliance checks becomes effortless with Creditsafe’s on-going monitoring feature. Our tool removes the need to manually schedule compliance monitoring updates, allowing your teams to focus on other priorities.

Add both individuals and businesses to be screened against the PEPs and Sanction databases on a daily basis, allowing you to relax in the knowledge that you are continually working with trusted partners and customers. As soon as we receive an update to suggest a change in circumstance to those which you monitor, Creditsafe's on-going monitoring will alert you so that you can make an informed decision on how to proceed.

Advanced screening

Our Politically Exposed Persons & Sanction checks search against databases including:

-

PEPs

-

Current & previous sanctions

-

Insolvencies

-

Financial regulator

-

Law enforcement

-

Disqualified director

-

Bankruptcies

-

Adverse media

-

Corporate registry

-

England & Wales Charities Commission

-

Companies House

-

Global ID verification

Check up to 5 of your customers for free today

Get the answers you need to make those vital business decisions quickly and accurately.

Have more than one individual or company you wish to screen?

Streamline PEPs and Sanction checks with bulk uploads & Integrated Solutions.

Bulk Upload

Screen your entire database of companies or individuals in one go with Creditsafe’s Bulk Compliance Search service. Import your entire ledger with ease and efficiency, allowing you to bring all of your historic records up to date.

On-going monitoring is required for regulatory compliance with the 4th Anti-Money Laundering Directive, making Bulk Compliance Search an essential tool to support regular monitoring of multiple clients.

PEPs & Sanctions API

For the ultimate streamlined solution to your PEPs and Sanctions checks, integrate our universe of global databases with your internal systems via our powerful API.

Build your own search giving you complete control, flexibility and access to our databases. With control in your hands, you can upload bulk files and screen customers or potential partners instantly whenever you need to.

Frequently asked questions

This check will allow you to see if a company has been sanctioned or if a politically exposed person has a connection to the company. There is no unique definition of a PEP, in fact the criteria varies from country to country and even company to company. A PEP does not necessarily mean someone who is involved in politics, it could include immediate family members, close business associates or even senior executives. These are key individuals and are important to check as a PEP presents a higher risk for potential bribery and corruption due to their position in society and the influence they may hold.

Standard AML checks do not screen clients against Her Majesty’s Treasury (HMT) list, while PEPs are not necessarily included in financial sanction checks. FCA registered companies are required to run the checks as day-to-day due diligence, not only to reduce their own company’s risk exposure, but to also comply with the current guidelines and stay within the law. It is also the responsibility of the credit or compliance department to carry out proper due diligence when investigating new clients. The guidelines set by the Joint Money Laundering Steering Group (JMLSG) state that every Financial Conduct Authority (FCA) registered company has to be fully aware of whom they deal with under AML and ‘Know Your Customer’ (KYC) guidelines. With a 30-40% increase every year in the PEPs list alone, it is important to screen new and existing clients to make sure they are compliant with the AML guidelines.

If a company has been sanctioned they have been issued a penalty by law for failure to comply with a court order, law or regulation. It is illegal to deal with a sanctioned company, so it is important to run a check on them and be compliant with the current guidelines set in place. If your company deals with a sanctioned company, even if you are a limited company, you may be personally prosecuted for this and could risk going to jail.

Your customers' circumstances can change frequently, meaning that a historic check may not reflect a customer’s status now. For this reason ongoing monitoring is a critical component of your compliance with the 4th Anti-Money Laundering Directive.

There is no definitive guideline to say how often your PEPs and Sanctions should be updated. However, our ongoing monitoring service will check the status of the customers you monitor on a daily basis to keep your records up to date.