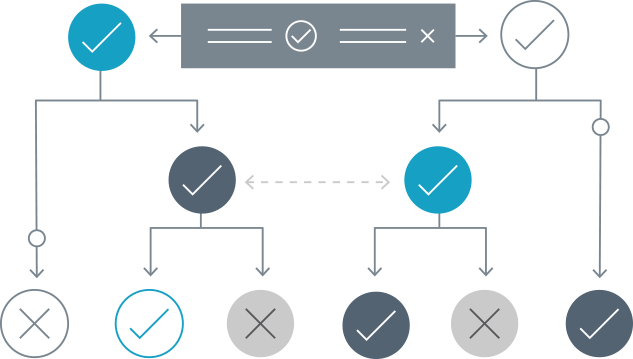

Decision Engine enables you to create and make the right decisions to grow your business. 53% of the best performing companies use automated data flows to drive better business decisions. Also, 41% of these companies are using this strategy to speed up their decision making.

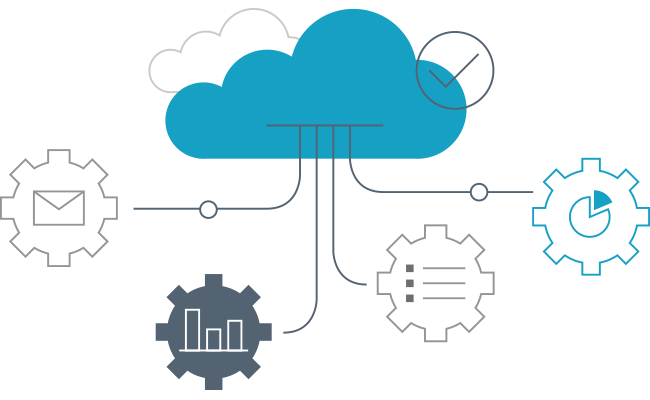

Powered by our next generation Connect API platform, Decision Engine can help you save time and money in your organisation by automating time-consuming processes that deplete your company's resources. The data-driven decision model allows you and your colleagues to focus on your core tasks and in achieving your business goals.