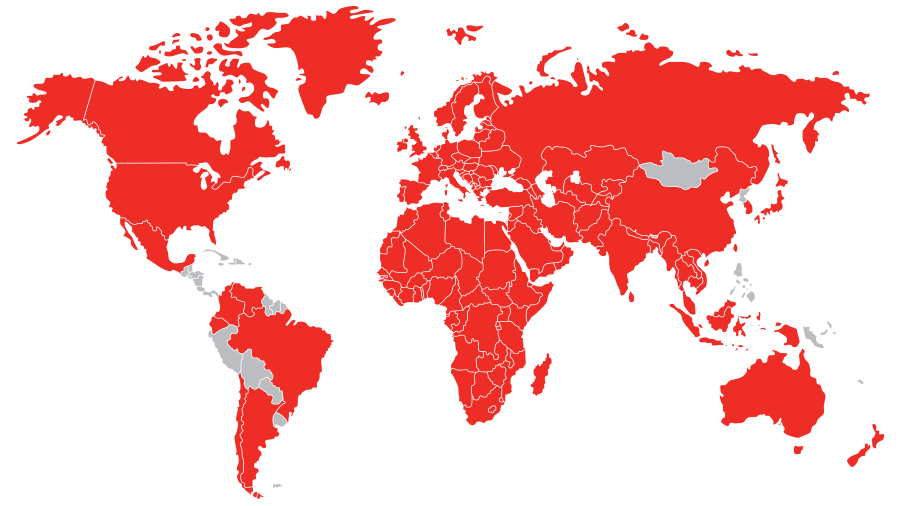

To make it easier for you when doing business internationally, all of the Creditsafe credit reports have a uniform international credit score. This allows you to compare credit scores (and the solvency) of companies around the world. By using the same score bandwidth and risk descriptions for all countries, we simplify the comparison of credit reports even further for you.

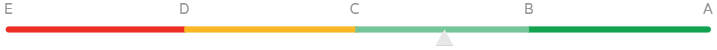

Our international credit score is set up in a simple way and ranges from a credit score A to E. Companies with an A-score represent the lowest credit risk, D is the highest credit risk and where an E-score cannot be assessed, because there is insufficient or outdated (financial) company data.

The Creditsafe company credit score measures the probability that a company will become insolvent or go bankrupt in the next twelve months.